Does the Graduated Income Tax Amendment “Add Up” for Illinois?

by Mary Ellen Daneels, Civics Instructional Specialist

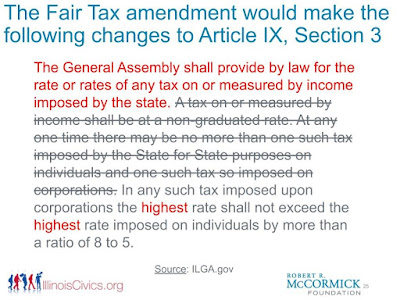

One of the more consequential questions on this fall’s ballot in Illinois is largely flying under the radar in the minds of most voters. Voters in the Land of Lincoln will weigh in on a measure to repeal the state’s constitutional requirement that personal state income taxes remain flat. The referendum would allow the state to enact legislation for a graduated income tax (see image below).

This ballot question provides #CivicsInTheMiddle classrooms an opportunity to engage in current and societal issue discussions around the essential question, “Is equal always fair?” This is a complicated, but important issue to address that combines both political and economic disciplinary content.

We curated a number of sources in our IllinoisCivics.org Election 2020 Toolkit to help you unpack this issue and other topics related to the November General Election. Below are resources explicitly tied to the Graduated Income Tax question.

- IllinoisCivics.org hosted a webinar, Does the Progressive Tax “Add Up” for Illinois?

- Illinois Constitution: see Article VIII, Section 2 (State Finance); Article IX, Section 1 (Revenue); Article IX, Section III (Limits on Income Taxation); and Article XIV, Section 2 (Amendments by General Assembly)

- Ballotpedia has an overview of the amendment that will appear on the ballot.

- Governor J.B. Pritzker’s Budget Address highlighting the Graduated Income Tax Amendment

- The Civic Federation: Graduated Income Tax Proposal, Part I

- The Civic Federation: Graduated Income Tax Proposal, Part II

- The Civic Federation: Does the Graduated Income Tax Plan Help Local Governments?

- The Civic Federation: analysis of the fiscal impact of COVID-19 on Illinois’ budgets

- The League of Women Voters of Illinois hosted a public program on the ballot question featuring Ralph Matiere of the Center for Tax and Budget Accountability.

- Truth in Accounting gave Illinois an “F” grade in a report titled “The Financial State of Illinois”

- The Paul Simon Public Policy Institute polled registered Illinois voters on their views of the proposed graduated income tax.

We hope you will join us this summer for our Civics In The Middle webinar series to support middle and high school civics implementation. The webinars are free. Registration links are available on the IllinoisCivics.org Professional Development calendar. Participants can earn two professional development credits through the DuPage Regional Office of Education for completing an extension assignment. Prior registration is required and details are available on the registration links.

IllinoisCivics.org is co-hosting a free 5-week micro-credential course in our Guardians of Democracy program on Current and Controversial Discussions with our colleagues from the Lou Frey Institute at the University of Central Florida. Participants can elect to earn professional development credits and graduate credits through the University of St. Francis for an additional fee.

What resources are you using to prepare your students for #Election2020? Please comment below. Together, we can prepare students for college, career, and civic life.

Comments

Post a Comment